Here’s A Quick Way To Solve A Tips About How To Settle A Insurance Claim

Once you’ve collected evidence and you know the full extent of your damages, it’s time to file your claim.

How to settle a insurance claim. Over the phone in person online by email via letter to claim the insurance on your own, you should reach out to your. Settling an auto insurance claim quickly might sound impossible, but it’s not. Tips for a smooth claim settlement.

Steps to respond to a low settlement offer remain calm and analyze your offer. Since state laws vary, make sure you check with the insurance commissioner's office in your state to see whether there are any other steps you need to take to settle the. When writing this type of letter, keep it simple and only include several key pieces of information:

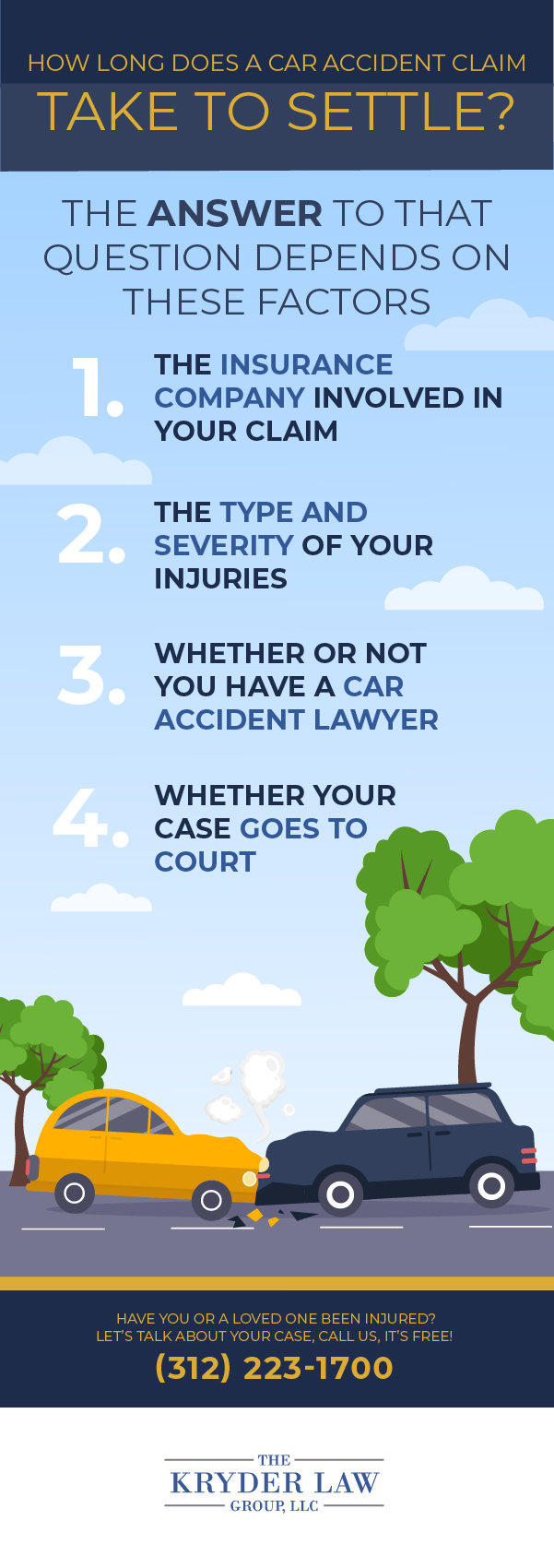

Keep all your documents organized. How long does an insurance claim take to settle? Prompt, transparent filing can help claims settle quicker.

Intimate the insurance company on time. When writing an insurance demand letter, you will have to state what your insurance claim is worth. This can be a tricky part for some, and.

If the damages are clear, easy to value, involve only property, and the person at fault is clear, claims can be settled quickly. Negotiate your settlement as you submit documentation for your claim, you will ask the auto insurance company for the amount of money that you feel is fair based on the property. Your first instinct might be to call you up your insurance company, demand to speak to the claims.

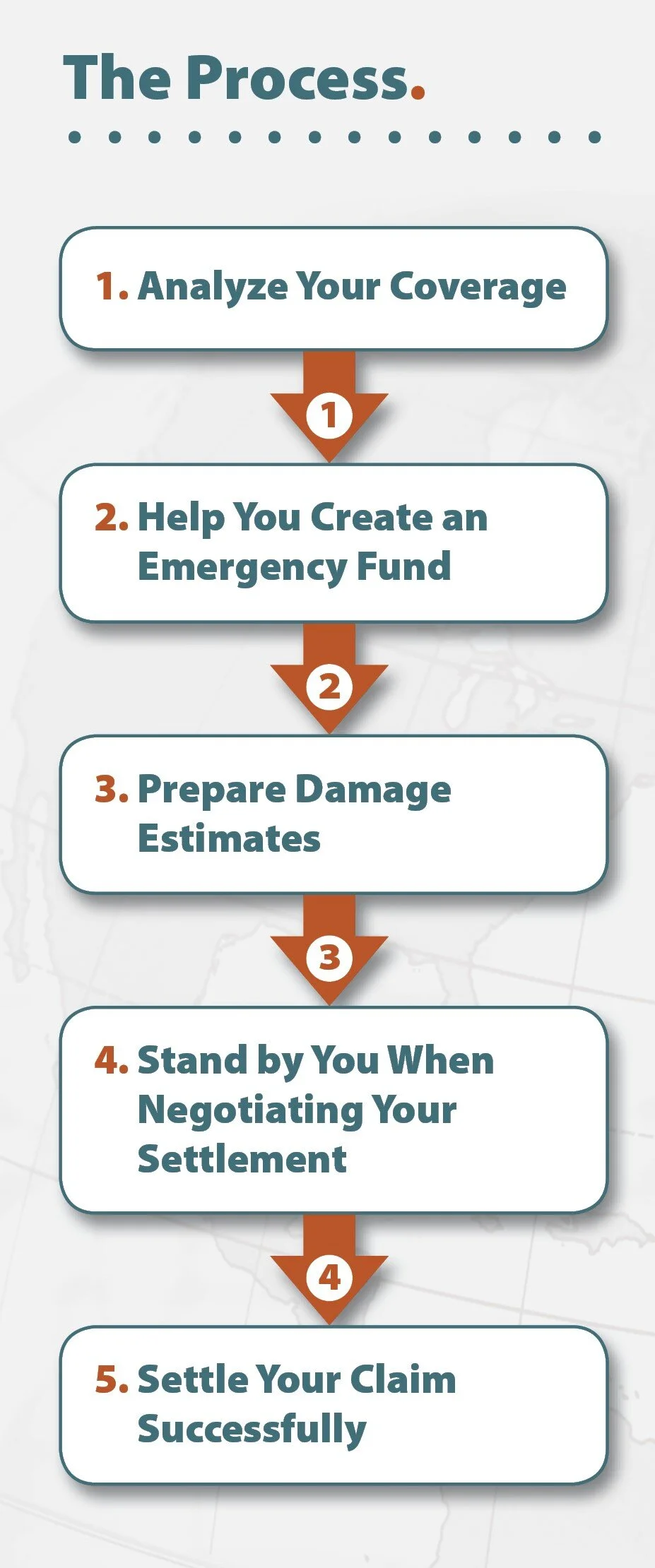

There are people who can help you, and there are steps that you can take to get your claim resolved. It varies, but generally it should take less than 45 days once the. Here are the most common ways you can file your insurance claim: