Spectacular Info About How To Get Rid Of Pmi Insurance

Pay down your mortgage enough

How to get rid of pmi insurance. Web you may be able to get rid of private mortgage insurance (pmi) once you have at least 20% equity in your home based on the house's original value. Web if you do decide to put less than 20% down and opt for pmi, here are three ways to get it taken off and reduce your overall costs. Web how to avoid pmi.

Web ways to get rid of pmi there are a few ways to stop paying pmi on a conventional mortgage. Get rid of pmi insurance. Web if the homeowner is a current u.s.

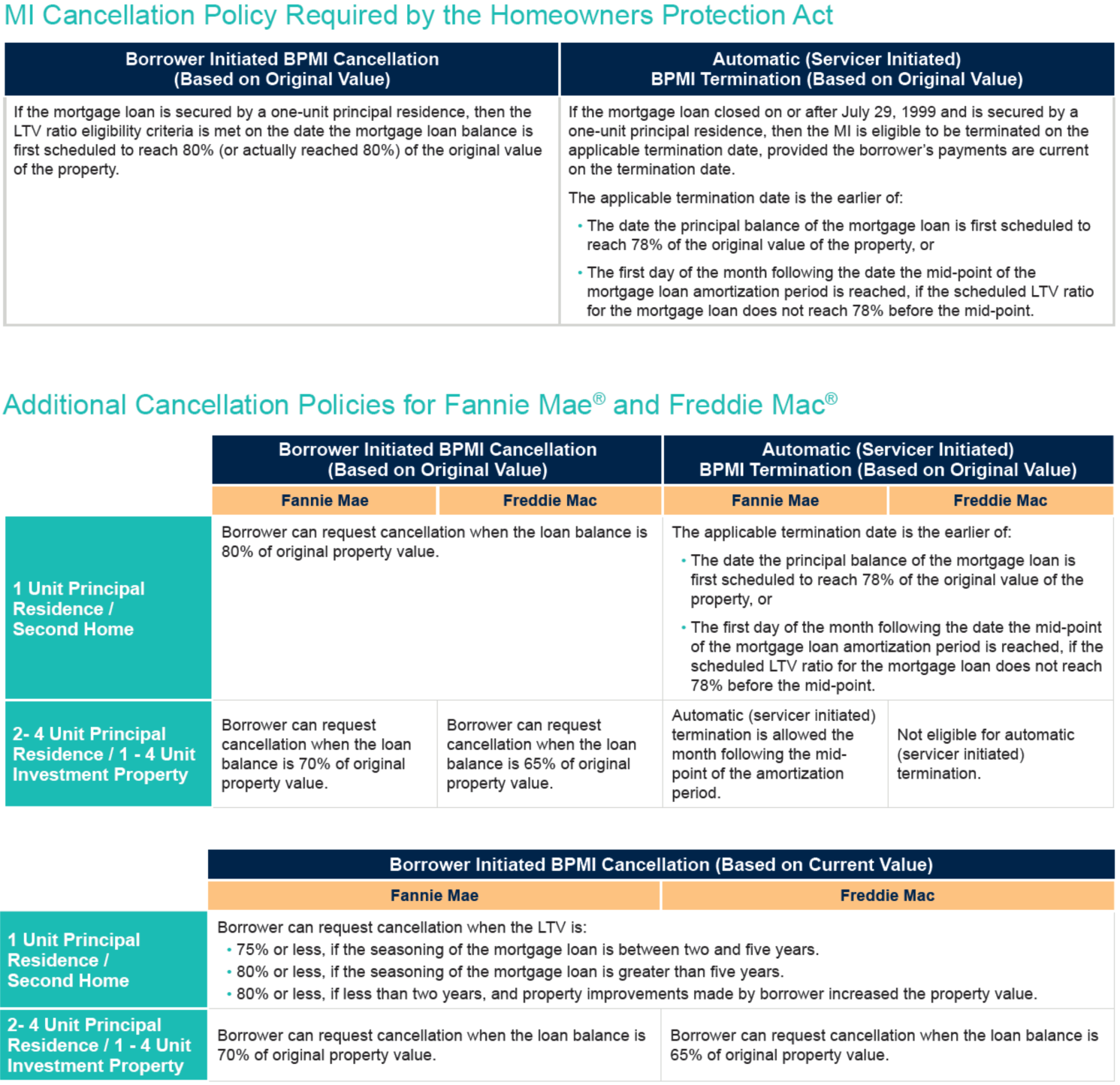

Make payments until pmi is canceled: For fha loans originated after june 3, 2013, it is much simpler to determine when the mip can be removed. (1) requesting pmi cancellation or (2) automatic or final pmi termination.

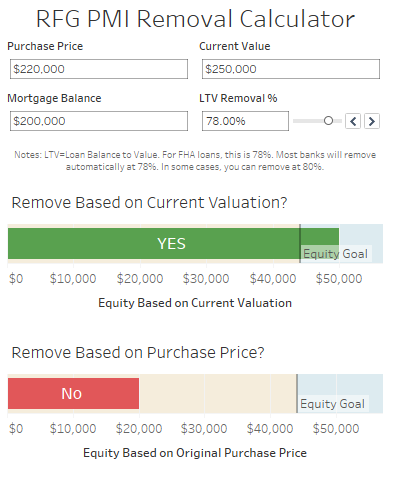

Usually, this happens either when your mortgage balance reaches 78% of the appraised value of the home, or. When you have a conventional loan, getting rid of pmi is just a matter of waiting. Web the law generally provides two ways to remove pmi from your home loan:

Web fha loans originated after june 3, 2013. Reduce your ltv ratio to 78% the most consistent way of removing private mortgage insurance. Ask to cancel your pmi:

Now stop imagining and start acting! Web after a certain amount of time, your pmi will automatically disappear. Web check out the steps below to discover how to get rid of pmi early.

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png)